2019 was a big year for e-commerce; Millennials did 60% of their shopping online (with 36% of purchases coming from mobile devices), New York enacted online sales tax collection laws, the US/China trade war kicked into high gear, and companies with customers in California had to scramble to become CCPA (California Consumer Privacy Act)-compliant before the law kicked into effect January 1, 2020. This article will dive into the trends in e-commerce and online marketplaces from 2019 in the consumer electronics/IT space, and global e-commerce trends from Newegg and e-commerce as a whole.

Compounding the complexity of the e-commerce landscape, the 2019 dramatic shifts took place on top of the continuing trends brands and retailers are trying to keep up with between influencer marketing, ever-increased shipping demands, handling customer returns, and Google’s increased monetization of their search properties.

Despite all the distractions and new trends impacting the e-commerce landscape, the result was a positive one; worldwide e-commerce in total grew 20.7% in 2019 to $3.535 trillion. This is a continued slowdown from the growth rates of 2018 and 2017 (28% and 22.9% respectively), however the overall portion of total retail that e-commerce is eating up is growing (14.1% in 2019, 12.2% in 2018, and 10.4% in 2017), and on a trajectory that puts e-commerce at a 22% makeup of total retail by 2023.

Looking at the domestic e-commerce market numbers from the US Census Bureau, 2019 brought $601.7 billion in sales, which is a 14.9% increase from 2018. Q4 was specifically a strong performance from the year prior, with a 16.4% lift. The year-ending quarter posted a 28.4% bump over the previous quarter in US e-commerce sales to close out 2019 on a strong note leading into 2020.

Online Marketplaces - Beyond the Retailer

In the not-so-distant past, the digital marketplace model was a fledgling idea viewed more as a fringe experiment in retail than as the predecessor to the modern e-commerce framework as we know it. Who would have known? Even with hindsight being 20/20, it would be impossible to predict the course that retail would take and the monumental impact that marketplaces would leave on the digital world.

Customer expectations. Price competition. Brand loyalty. Customer reviews. User-generated content (UGC). Shipping. Some of the core elements of modern shopping have their roots in the marketplace model.

Today, the pillars of online marketplaces have become mainstream tenets of e-commerce. According to Internet Retailer, the top 100 marketplaces in the globe accounted for 58% of the world’s $2.86 trillion e-commerce market, and of surveyed US consumers, 92% shopped online multi-merchant marketplaces. For some historical context, in 2017 98% of online shoppers in Asia reported making a marketplace purchase, which takes the pole position in marketplace penetration by region.

Asia online consumers shopping on marketplaces in 2017

US online consumers shopping on marketplaces in 2019

98%

Yes

2%

No

92%

Yes

8%

No

Narrow the Audience to Target Sales Growth

While the rapid growth of the marketplace model would seem to indicate the loss of ground to traditional retailers and brands, an emerging trend to cope with the changing landscape has been the adoption of a direct-to-consumer (D2C) approach. Through this model, brands and retailers alike have jumped aboard the marketplace train to establish additional digital floorspace. This has allowed for sustainable growth for the retailers by leveraging the various marketplace audiences. Not only does this produce sales in the short term, but it acts as a branding play to acquire loyal customers in the long-term picture. In fact, 26% of the global Top 1000 Retailers sell on online marketplaces, showing the evolution of the retail model driven by consumer demand.

Interestingly enough, 44% of consumers polled by Internet Retailer say they have purchased from a seller’s own website after finding their products on a marketplace. Proof that merchants are aquiring new customers by selling on marketplaces.

When shopping on a marketplace, are you willing to purchase from brands you’ve never heard of before?

35%

Yes, I will buy from any seller if I trust the marketplace

25%

Yes, I will buy from any seller that offers the best price

13%

Yes, I will buy from any seller if I trust the brand

12%

Yes, I will buy any brand if I trust the seller

9%

No

6%

I don’t know

Results from Internet Retailer 2019 Online Marketplaces survey

This movement uncovers the true value that marketplaces provide to retailers and brands – segmented audiences. The beauty of the D2C marketplace movement is that retailers can pick and choose which platforms they will sign onto, and how they will brand themselves on each platform to best mesh with the customer demographics. Many marketplaces have a unique character or theme which is synonymous with their audience demographics, often referred to as “niche marketplaces”. For example, certain “niche marketplaces” specialize in handcrafted goods, consumer electronics and IT components, or an array of other elements.

However, “niche” doesn’t mean small.

Of the global Internet Retailer Top 100 Marketplaces, 44 are categorized as “niche marketplaces”. Collectively, these marketplaces grew total GMV 22% to $29.5 billion in 2018, marginally higher than the 20.1% growth of the overall Top 1000.

According to the Internet Retailer Top 100 Online Marketplaces report, Newegg is listed as the 5th most popular online marketplace, as polled by the Top 100 Online Marketplaces Merchant Survey. With a Consumer Electronics and IT component focus (ranked globally as the #1 marketplace in this category), the demographic for Newegg is ideally positioned to be receptive to certain brands, retailers, and messaging to that effect. Savvy brands from other peripheral industries are also able to profit from the consumer segment by positioning their image in a way that targets the characteristics important to the customer base.

Tech Industry Domination - Consumer Electronics & IT Growth in 2019

The parameters of the tech industry used to be more clear cut. Computers, TVs, PC components, laptops, digital cameras – those were mainstays of the CE/IT world. Now in 2020, the “Consumer Electronics” label can apply to a much wider swath of the market. Everything from light bulbs to door locks are getting injected with Wi-Fi connectivity, app control, and expanding the tech industry beyond traditional boundaries and into other areas of the market.

According to a recent Consumer Technology Association (CTA, the company that operates CES) report, 2019 growth for the overall Consumer Electronics industry was pegged at 2.2%, totaling $401 billion in retail revenue. While that is a steep dropoff from the 6% growth the year prior, expectations are high that 2020 will produce positive results.

As reported by CTA, several large categories had a standout year in 2019, with promising outlooks:

True Wireless Headphones/Wireless Earbuds

With the direction Apple has taken with the iPhone to eliminate the audio jack from their phones and the introduction of their Airpods, true wireless Bluetooth headphones are a growing trend that picked up steam in 2019 and will continue into 2020. The Beats by Dre Powerbeats Pro and Jabra Elite 65t among other frontrunner wireless earbuds sold $2 billion in 2019, a 46% increase year-over-year.

Beyond the growth as a reactive force to other changes, the wireless headphone/earbud category is projected to increase as true wireless technology (ie. no connection wire between earbuds) delivers premium audio quality.

Smartphones

Smartphone units in 2019 had a 2% decline to 165.5 million units, which equates to a 2% drop in revenue settling at $77.5 billion for the year. This is the largest category in consumer technology, and the drop can possibly be tied to an overall lack of new features for customers to purchase the new phone models. Additionally, smartphone unit sales for Apple in the second quarter were down a hefty 13.8% year-over-year, which continued a negative performance from the first quarter of 2019.

TVs

2019 saw an increase in the adoption of OLED TVs as the technology has become more cheaper. and more accessible to a wider customer base. 4K TV upgrades continue to drive new TV sales. Even with a slight 1% increase year-over-year for units (38.8 million), revenue was still down 9% following a blockbuster year in 2018.

With bigger TV sets 75”+ driving upgrade models and 4K TVs driving a 6% increase to 17 million units, ironically the reduction in technology cost resulted in a 6% year-over-year drop in revenue.

Laptops

In 2019 laptops in the US had a 2% growth year-over-year to 51 million units, netting a 3% lift in revenue. Growth within this sector of the cloud-based models like Chromebooks, and convertible models like Microsoft Surface Pros will propel the market forward.

CE/IT Category Growth on Newegg Marketplace

As a premier destination for Consumer Electronics and IT Components, some of these larger industry trends are oftentimes observed in the microcosm of the Newegg ecosystem. 2019 delivered some interesting growth patterns in the CE/IT verticals that for use here will be aggregated into the general classifications of Electronics, Components/DIY/Networking, Home & Living, and B2B.

Electronics

The industry-wide boost in TV sales was also felt within Newegg, as sales for LED TVs in 2019 surged 43.6%. Unlike the recent market dampening felt across the board by Apple, iPhone unit sales on Newegg increased 7% year-over-year, with a roughly 5% increase in revenue. One of the surprise growth categories for the year was point & shoot cameras, which saw almost a 20% lift in revenue. In the same vein, action cameras drove over 100% increase in units moved.

Components, DIY, & Networking

Since the beginning, Newegg has been a haven for PC enthusiasts, gamers, and DIYers so it is no surprise that across the board these categories and relevant ones have seen significant growth in 2019. That being said, there are a few subcategories that have shown some interesting growth trends.

Whole-home Wi-Fi unit sales were up 80%, with a 55.73% increase in revenue. Similarly, range extender revenue was up 33.29% in 2019 which shows the customer demand for quicker and more reliable wireless internet connectivity. Also, with the Smart Home market growing and more connected devices relying on high-speed internet for utility, it makes sense that these support categories will also grow alongside the main smart devices.

When it comes to PC components, AMD-compatible motherboards showed very strong growth with 14% lift in units and a 44.04% increase in revenue for the year. This is in large part a result of the big year AMD had for its product launches, specifically in the high-performance processor space. They released the Ryzen Threadripper desktop processor family, which put four new CPUs into the market. The halo effect of this expansion of their product line has reached outward to other desktop components like graphics cards for gaming and professional creator use.

External Solid State Disks (SSDs) had a 32% increase in units sold during 2019, and operating systems had a big year with a 59% lift in downloads, while software application licenses increased 54.18% in revenue for the year.

Home & Living

While not the traditional Consumer Electronics staples, many electronic goods in these areas saw marked growth as techy customers expand outside the typical finished good and component purchases.

Upright vacuums had a monster year, with a 143% unit increase in an already powerful category, while broom and stick vacuums fared positively as well with a 67% increase in unit sales.

Speaking again of the burgeoning Smart Home market, smart plugs and LEDs saw a 26.16% lift in revenue, coming off a very hot 2018 for the home automation industry. While the new product market seemed a bit cooler overall in 2019 compared to years prior, CES 2020 showcased a slew of new tech for the connected home that will prove to make 2020 a very interesting year for the connected lifestyle space.

B2B

While it is well understood that the consumer marketplace model is a major driving factor in e-commerce, it should also be noted that the surge in B2B e-commerce is also changing the landscape for business shopping. In fact, 2018 marked the first year that B2B e-commerce surpassed $1 trillion in sales, according to the 2019 US B2B E-Commerce Market Report by Digital Commerce 360. If you’re in the e-commerce game and not taking advantage of the B2B market, something is wrong.

The solution? B2B marketplaces. Now in 2020 we’ve already seen this change taking place as younger customers who are more accustomed to the modern e-commerce way of purchasing products for personal use, enter the business world and expect the same efficiencies and convenience. According to Digital Commerce 360, “By next year (2020), online marketplaces are expected to account for 40% of the global online retail market. In B2B, that impact is already being seen especially in procurement. Gartner estimates that 75% of B2B procurement spending will happen via an online marketplaces within the next five years, and the simplicity of doing business this way is likely to “create a butterfly effect on the e-commerce trend.”

While Newegg has had a B2B marketplace for seven years with a very strong presence in the CE/IT space, 2019 held major growth of some core categories. Enterprise SSDs for example, grew 182% in unit sales which drove a 73.45% year-over-year lift in revenue. Server memory unit sales increased 61%, while server motherboards and printer ink cartridges showed revenue growth of 11.97% and 11.70% respectively.

Trends Shaping the E-Commerce Market

With high consumer confidence and low unemployment at home in the US, the e-commerce market had a healthy outlook and has been playing the hot hand for some time now. With the complex global economy however, things can change rather quickly. Considering the global consumer spending slowdown led by a faltering Chinese economy as well as plateau in the European GDP growth, we may see reduced consumer spending across the board in the near future. Factoring in the impact of COVID-19, the immediate future is certainly a big question mark for everyone.

Brick-and-mortar retail still drives the lion’s share of total retail in the US at 89.3%, with 55% of total retail growth, according to eMarketer. The flipside of this stat is that e-commerce is making up the other 45% of total retail growth — with only 10.7% of total US retail spending. It is plain to see that e-commerce is punching well above its weight class in terms of growth. This e-commerce growth trend is expected to continue without any sign of turning around, especially as more markets that are traditionally brick-and-mortar or offline (like grocery or B2B shopping) move to adopt the e-commerce model.

Consumers and their homes that are becoming more and more integrated with voice assistants, and smart devices will continue to take over more real estate in the household. As the Smart Home market grows (16.5 million shoppers purchased a Smart Home device in 2019), intelligent devices that add control and interconnectivity to home operations or automated devices that replace traditional “on/off” devices will begin to eat up more market share from their “dumb” predecessors. With this increased smart device use in the home, connectivity to Wi-Fi and the need for increased bandwidth with grow as well.

According to NPD, buyers are not replacing tech items nearly at the same rate as they did in previous years (case in point cell phones), however the same cannot be said for TVs which are showing high sales growth and reduced unit price. With new technology incorporated into new television sets and the dollar being stretched further, sales can be expected to have a rosy outlook.

Global E-Commerce of 2019

Since Newegg’s expansion into 20 total countries there were some key regions that showed promise in 2019 outside of the home US market, most notably Middle East North Africa (MENA) and South America.

Saudi Arabia took lead in the MENA region for Newegg with orders up 114.7% year-over-year in an already very active market, and the second runner-up United Arab Emirates (UAE) saw customer orders grow 57.2% in the same timeframe. For South America, Chilean customer orders swelled 20.1% and Argentina, which was launched in June 2019, showed rapid growth with a high long-term growth potential. Across the board, average order value for global customers on the Newegg platform tends to be about double what the US customers spend, which is likely contributed to higher international shipping costs and a more narrow shopper demographic for high-end gamers and core IT component enthusiasts.

When it comes to the broad global e-commerce landscape, Western Europe and the EU region have a mature e-commerce market, which combined with economic uncertainty surrounding Brexit have contributed to a slower global e-commerce growth in the market in 2019.

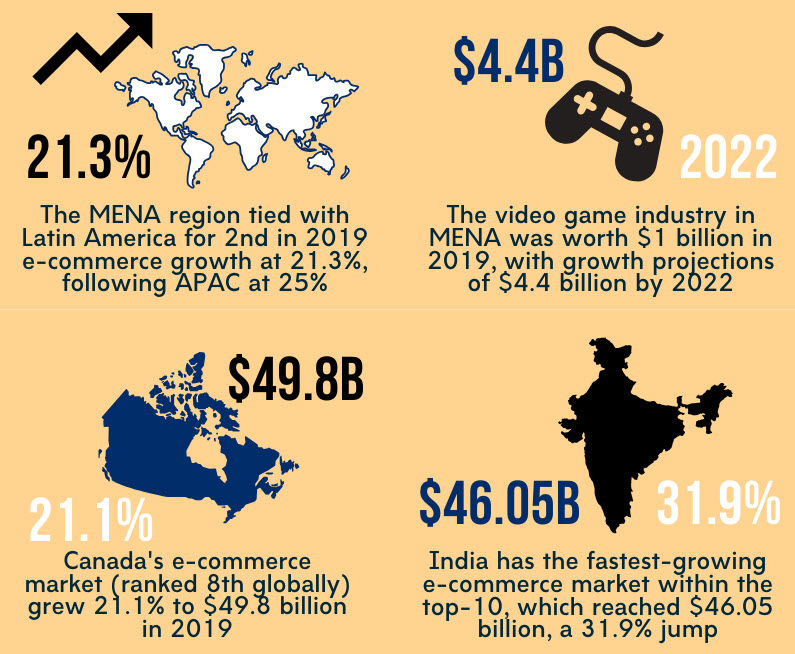

While the e-commerce growth rate is slowing from its explosive 2017 performance (28%) and projected to continue slowing down to 14.9% growth by 2023, the global e-commerce market is still getting much bigger. According to eMarketer and supporting the Newegg findings, e-commerce sales growth as a whole was very strong in the MENA region in 2019, tying with Latin America for second place at 21.3% year-over-year. In part this is due to a relatively immature online sales market, with plenty of room to grow.

This contrasts sharply from Canada’s advanced online market, which continues to see strong growth rates. As the number 8 e-commerce market globally, they grew 21.1% to $49.80 billion in 2019. Despite the overall digital maturity, online commerce in Canada has traditionally lagged due to logistical inefficiencies. The vast geographic dispersal of Canada’s population has made developing distribution centers and delivery capabilities cost-prohibitive, however recent advancements are aiding in bringing more shopping dollars online at an increased rate. Online marketplaces in Canada are not nearly as plentiful as in the US or some Asian countries, however this offers more growth potential in a rather unsaturated market.

Of all the global e-commerce markets, India holds the fastest growth rate within the top 10, which is 31.9% at $46.05 billion in 2019. Although India represents one of the world’s largest economies, the online retail market is relatively new due to the large percentage of lower-income populous and immature infrastructure to support payments and delivery. However, even with this relatively youthful retail transition, online marketplaces in India are bountiful, so there is no shortage of opportunity to target the country’s massive population.

Online Marketplaces in the Future

2019 was clearly a major year for online marketplace expansion in terms of customer use and overall growth within the retail sector. With the e-commerce market shaping up to continue this strong trend in 2020, now is the perfect time to capitalize on the movement if you have not already. Newegg Marketplace is a premier online marketplace for Consumer Electronics, IT products, and any tech-related items for the home, outdoors, or office. Apply today to discover the full suite of marketing tools, global expansion opportunities, and logistics infrastructure benefits that Newegg can offer for you to drive more sales in 2020.